Morning!

Let’s get right into it.

It’s Saturday January 23, 2021.

WallStreetBets

Here’s the best stat I’ve seen in a while: short interest in GameStop, the mostly brick-and-mortar retailer that sells video games and consoles, has now reached 144% of its float, meaning that there are more GME shares being shorted than actual shares available to trade. Ouch!

If you think GME stock is in the dumps, however, think again. On Friday, GameStop reached an all-time of $76.76, triggered a trading halt, and closed off the week off at $65.01. The last six months haven’t exactly been bullish for brick-and-mortar retail, yet GameStop is up a staggering 1,480% from its $4.11 price in late July 2020. So what in the world happened here?

First, Chewy.com cofounder Ryan Cohen took a 10% stake in the company, joined its board of directors, and pledged to help the embattled retailer “promptly pivot from a brick-and-mortar mindset to a technology-driven vision.” If you are satisfied by this explanation, feel free to move on to the next story below.

If your faith in efficient markets has been shaken, however, I present to you: WallStreetBets vs. Short Selling Hedge Funds.

With all due respect to Cathie Wood and Ark Invest, WallStreetBets - a Reddit group of retail investors who float mostly insane ideas and then collectively go all-in - might be the world’s most influential capital allocator at the moment.

If there are three certainties about the Redditors, it’s that (i) they love derivatives, (ii) they love insolvent companies (see: Hertz) and (iii) they hate shorts (who they frequently refer to as communists and more pejorative terms not fit for printing).

Insolvent, heavily shorted, and with a then-sub $1B market cap, GameStop is to WallStreetBets what Geico was to Warren Buffett. And when long derivative buyers and short-biased funds clash…

On Tuesday, noted short-seller Citron called the GME buyers “suckers.” Since then, r/WallStreetBets and its 2 million self-styled degenerates have almost exclusively been posting about GameStop, promising to take the stock to $100 per share, and hacking Citron’s conference calls.

Then, yesterday, a record 913,000 GME calls were traded during the day, with the most popular being a $60 contract (expiring the same day!) that started the day 30% out-of-the-money and ended the day up 2,700%. Insanity.

Unfortunately for WSB, however, I can’t help but think the wildly successful GameStop trade might be the beginning of the end for the subreddit. The page openly pushes the boundaries of legality and good taste, arguably destabilizes markets, and offends whatever notion remains of prudent investing. To be fair, many a hedge fund could be accused of doing the same thing, but WallStreetBets does it much more… brazenly?

As an advocate for retail investors, I don’t have much sympathy for calls to shut down investing forums. Sure, they may lead to coordinated buying, but a single institution can move markets just as much as thousands of “investors” armed with stimulus checks. Still, headlines announcing a ban on the subreddit could soften the blow:

SEC shuts down WallStreetBets; infamous subreddit deemed a threat to short selling industry.

I’d frame that.

Software as a Car

On Tuesday, Microsoft and GM announced a new strategic partnership whereby the tech giant would help Cruise, the GM-backed self-driving company, develop its cars.

As an outsider who knows next-to-nothing about the industry, this is an exciting development. Traditional cars are hardware that become outdated the minute you drive them off the lot. Ride in a Tesla, however, and the owner will surely show off the new updates and capabilities that the car downloaded overnight. Tesla builds hardware, sure, but also software!

While the benefits to GM and Cruise are obvious, I’m most curious about how Microsoft can integrate the self-driving venture with their other services. If your warehouse solutions are powered by Microsoft’s cloud and your back office runs on Office, having your trucks run on Windows/Cruise might have its perks.

GM is up 10.87% since the announcement, Microsoft is up 6.25%, and Cruise recently raised $2B at a $30B valuation. More importantly, we’re a step closer to the Windows XP-powered Camaro we’ve always dreamed of!

Things You Shouldn’t Put In Writing

On Thursday, online luxury retailer MyTheresa went public at a $3B valuation. Not bad for a company that Neiman Marcus acquired for $200M in 2014!

MyTheresa’s time as a Neiman subsidiary is truly riveting. Rather than keep you here much longer, I’ll just refer you to this piece in Financial Times. The short of it though: Neiman’s private equity owners transferred MyTheresa out of their main operating entity and into another entity, where it was out of the reach of the chain’s bondholders.

The company almost got away with it, but one pesky hedge fund holding $60M of the Company’s $5B of debt took Neiman to court and, eventually, secured a piece of MyTheresa for debt-holders. All in all, it was a great private equity vs. hedge fund fight; one side is the Lakers, the other the Celtics, and MyTheresa is the Larry O’Brien Trophy.

Unfortunately for the prevailing hedge fund manager, however, he then actively tried to dissuade bidders from purchasing the creditor’s shares of MyTheresa - hoping to buy them all himself at a steep discount - and sent this message to Jeffries via Instant Bloomberg:

Stand DOWN. DO NOT SEND IN A BID.

The thing is… that manager also sat on Neiman’s creditor committee, so… classic breach of fiduciary duty? Let’s let the accused decide. His follow-up message to Jeffries:

They’re going to say that I abused my position as a fiduciary, which I probably did, right? Maybe I should go to jail. But I’m asking you not to put me in jail.

Yikes. He has since been arrested and his fund was unwound.

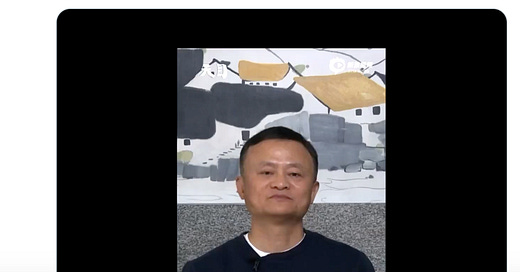

Nothing To See Here

Last week, we talked about Jack Ma’s disappearance. This week, Chinese state-affiliated media delivered good news:

Well that settles it. Ma’s doing great.

Have a great weekend!