Good morning!

I’ve always been curious about why roses were such a thing on Valentine’s Day. In a world where no one agrees about anything, and where there are millions of potential gift options, how did everyone settle on roses?

The story I’ve since been told - and which I didn’t fact check - is that roses were historically meaningful because they were so difficult to obtain. In the pre-refrigerator era, the story goes, flower shops were scarce and would-be suitors had to scour the wilderness in the hopes of finding their prize.

While that’s a satisfactory explanation, it’s now 2021 and the romance of the rose hunt died with 1800FLOWERS.com. We need something new.

Well, according to Cambridge University researchers, Bitcoin mining is so energy intensive that miners have used more electricity in 2020 than the whole country of Argentina. To mine a Bitcoin, you need electricity-guzzling super-computers, running around the clock, completing sophisticated puzzles. Now THAT sounds like arduous work.

So, if you were looking for a meaningful, romantic gift for your significant other this Valentine’s Day… you’re welcome.

It’s Saturday February 13, 2021.

SoftBanked Eggs

On Friday, Coupang - a company best described as the South Korean Amazon - filed a a Form S-1, setting itself up to IPO this year. With a $50B target valuation, this would be the largest New York IPO for a non-US company since Alibaba in 2014.

This is obviously great for Coupang, but perhaps even moreso for SoftBank. The Japanese conglomerate invested $1B in the South Korean e-commerce company in 2015 and another $2B in 2018. The 2018 fundraising round valued Coupang at $9B, so that round’s investment alone might represent an $8B windfall for SoftBank.

This is welcome news for the Japanese conglomerate, who had a difficult 12 month period, beginning with WeWork’s disastrous failed IPO in September 2019 and ending with SoftBank being exposed as the Nasdaq Whale that lost nearly $3B on derivatives trades in September 2020.

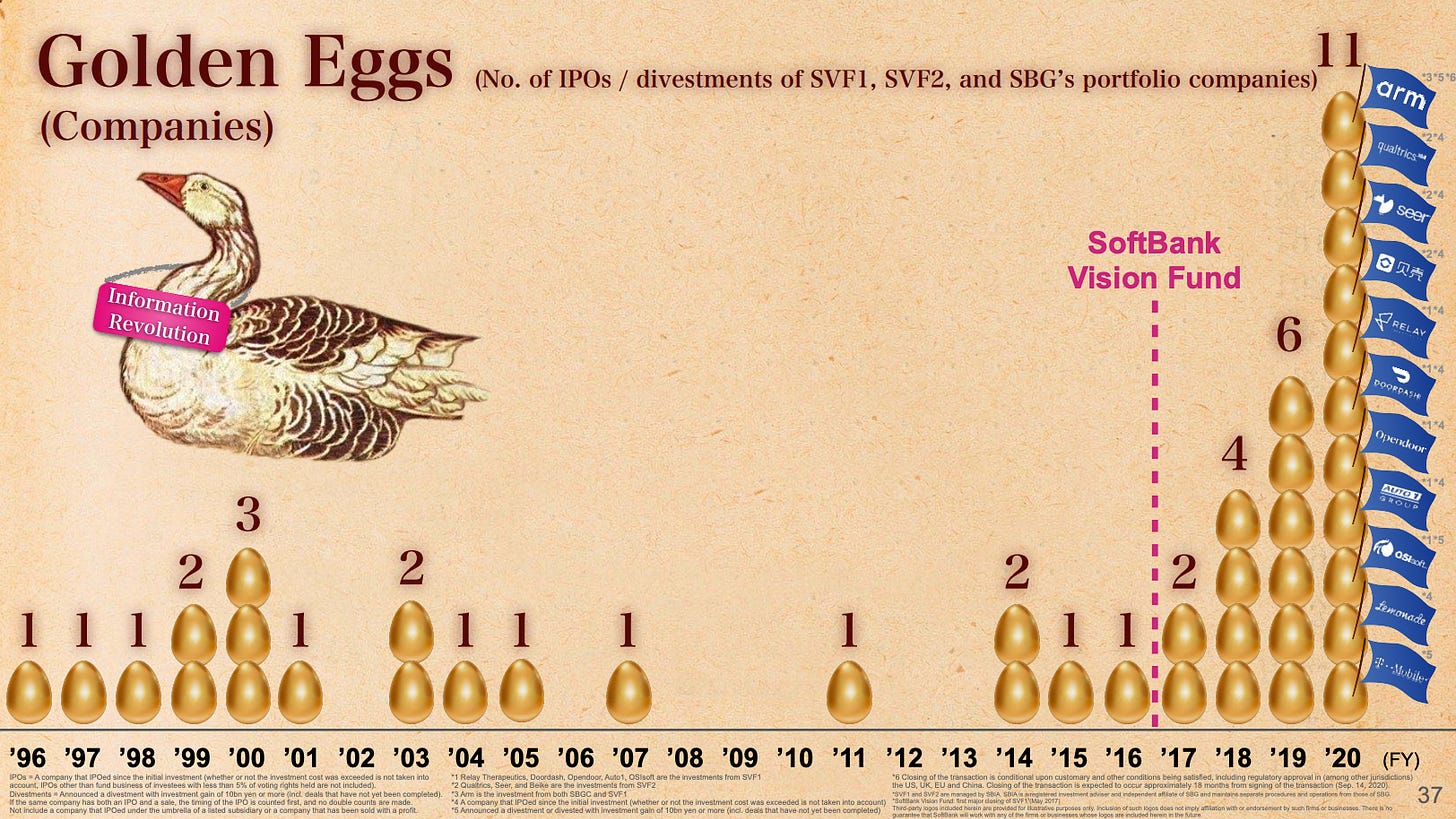

Now, however, SoftBank is on a heater. 11 of its portfolio companies have gone public since the pandemic began - including DoorDash and Lemonade - and its Vision Fund posted $13B gains in Q4 alone. Even its Uber stock is at all-time highs!

Anyways, this was all just a long intro to justify showing you some slides from SoftBank’s latest earnings call. Building off an unmatched legacy of ludicrous Power Points, SoftBank did not disappoint with its 2020Q4 investor presentation.

To begin, the House That Masa Built asked investors a thought-provoking question:

Next, the company offered an uncharacteristically plain, obvious, and boring answer:

But then, things got weird (and exciting):

I mean… that’s amazing.

An incredible rebound. An over-the-top aesthetic. A Hall of Fame track record with a few notable blemishes. We’re all thinking it: SoftBank is the Dennis Rodman of the investment world.

The full 2021 deck is available here.

They Said It Best

We’ve discussed issues with passive investing a few times. Conceptually it’s great, but at scale, it distorts markets and increases fragility.

For those interested in this admittedly niche (but important) subject, I recommend reading this piece published on Wednesday by Carson Block, founder and CIO of renowned short selling firm Muddy Waters, LLC.

Block discusses GameStop, as well as research from Michael Green of Logica Funds, who has become the leading voice on issues concerning passive. Of note:

Green estimates that when an incremental dollar is put to work with an active manager, it has an average effect on aggregate market capitalisation of $2.50. The multiplier occurs because the number of shares available is smaller than the total number of shares outstanding, and a buyer must often pay a premium to induce a shareholder to sell.

However, Green estimates that when a passive fund receives an additional dollar, the automatic decision to maintain balance by buying in proportion to market capitalisation results in an increase in market cap of more than $17!

Passive funds have a much greater impact on prices because active investors can be patient in deploying their capital and are sensitive to the prices they pay. Passive funds have little discretion whether and at what price to buy — they must buy if they have inflows. Perversely, passive funds’ demand for a stock generally grows as the price increases because the weighting of the stock in the indices they track increases. So long as such funds have inflows, they do not sell.

Bitcoin Stuff

Even by cryptocurrency standards, this was a crazy week for Bitcoin that hit an all-time high of $48,925.53. Let’s look at a couple highlights:

Monday: Tesla announced that it had purchased $1.5B in Bitcoin, as part of a plan to diversify its treasury reserve and to begin accepting the cryptocurrency as payment for its cars. Tesla is the second major company to adopt BTC as a treasury reserve, after MicroStrategy who made Bitcoin its primary reserve in 2020 and currently holds roughly $3.5B of it on its books. Other companies, such as Square, have also began buying Bitcoin, albeit in much smaller quantities.

Wednesday: Mastercard said it would support certain cryptocurrencies on its network.

Thursday: Miami’s city commission decided in a 4-1 vote to explore holding some of its own reserves in Bitcoin, as well as offering to pay employees in the currency. Elsewhere, BNY Mellon, America’s oldest bank, announced the launch of a Digital Assets Unit, which will allow its asset management clients to custody Bitcoin with the bank.

Friday: Apple Pay began accepting Bitcoin funded credit cards and PayPal announced plans to add the cryptocurrency as a method of payment on Venmo, its mobile payment app with 52 million users.

Just a Thought

Over the last nine months, much has been made about the stimulus-fueled rise of retail investors and for good reason: WallStreetBets, for example, is replete with posts from users openly “YOLO-ing” their “stimmies” on out-of-the-money call options. They want their Lambo and they want it now!

What has been less discussed - or perhaps I just missed it - is the effect that student loan forbearances have had on the market.

As a JD, I have many attorney friends and former classmates. While individual compensation varies greatly, attorneys statistically earn more than the average person. Some - think associates at Big Law firms - make $200,000 their very first year out of law school! By the same token, however, many of these same people carry six-figure debt loads accruing interest at (blended) rates in excess of 6%. The same phenomenon can be observed with engineers, doctors, you name it.

For the better part of a year now - and continuing until at least October 2021 - 42 million Americans have benefitted from a pause in interest accrual and monthly payments on their student loans. These (temporary) savings add up quickly; heavily-indebted higher earners have had stimulus-sized increases to disposable income… on every paycheck!

Sure, these people aren’t representative of the entire population and others have availed themselves of the forbearance to increase their loan payments and aggressively pay down principal. Still, a non-negligible number of people likely invested the “additional” income and that cohort’s CARES Act-adjusted liquidity is an order of magnitude greater than the average stimulus check recipients’.

That must have had an effect on the market? I’m sure someone at the University of Chicago already proved or disproved this point, but if not, I guess we’ll find out when the forbearances run out.

Have a great weekend!