Good morning!

And to those on the East Coast, good afternoon! The first PM Edition, I guess. What a milestone…

After its deal to sell Victoria’s Secret to Sycamore Partners fell through due to the pandemic, L Brands has now announced plans to spin off the lingerie brand into its own publicly-traded company.

Spin offs are tax-free transactions and, by splitting Victoria’s Secret and Bath & Body Works into two separate companies, L Brands hopes to capitalize on both companies’ 2021Q1 bounce back to unlock more shareholder value.

We’ll see if it works. For our part, with Playboy also now publicly traded, we’re just counting down the days until someone inevitably launches a new vice ETF.

The SEX ticker symbol is available. Just sayin’…

It’s Saturday May 15, 2021.

Hack

Friday of last week, hackers launched a ransomware attack on the Colonial Pipeline network - a pipeline that runs from Texas to New York and moves nearly half the fuel consumed on the East Coast.

On Monday, the FBI blamed an aptly-named Russian hacker group, DarkSide, for the attack. The fallout has been well-documented by most outlets: the Federal government enacted emergency powers, miles long lines formed at gas stations, and Colonial paid a $5M ransom to DarkSide.

In a way, DarkSide’s “business model” resembles that of McDonald’s; whereas the latter has both corporate-owned restaurants and franchises, the former does hack jobs for its own account, but also licenses out its hacking software to others in exchange for a royalty.

The Colonial Pipeline hack was purportedly orchestrated by one such “franchisee”, which prompted DarkSide to put out this statement on Monday:

We are apolitical, we do not participate in geopolitics, do not need to tie us with a defined goverment (sic) and look for other our motives. Our goal is to make money, and not creating problems for society. From today we introduce moderation and check each company that our partners want to encrypt to avoid social consequences in the future.

To state the obvious, I do not condone hacks, but man… what a statement! Gentlemen hackers, I guess. Arsène Lupin would be proud.

On Friday, blockchain compliance group Elliptic put out a report, tracing the payment of the ransom (which was paid in Bitcoin) to a crypto wallet associated with DarkSide. The wallet, established in March, has already received $17.5M in payments, in a sign that ransomware attacks are a rapidly growing problem… and business.

While DarkSide pledged to improve its KYC procedures and vetting of fellow criminal counterparties - I mean… you can’t make this up! - those plans are probably on hold now.

According to FireEye - the company that, as readers of The Saturday may recall, uncovered the Orion hack - DarkSide has told affiliates that it was shutting down due to enhanced law enforcement scrutiny resulting from the Colonial hack.

According to another cybersecurity company (CrowdStrike), DarkSide itself was a spin off of a criminal organization known as Carbon Spider, so it wouldn’t be all that surprising to see DarkSide reinvent itself rather than disappear forever.

For those curious - and, as a reminder, nothing in these parts is investment advice - FireEye’s stock ticker if FEYE and CrowdStrike’s is CRWD. There is also a cybersecurity ETF, ticker BUG.

Better SPAC

We last spoke about online mortgage company Better in November 2021, when Forbes published a not-so-flattering exposé on the company’s CEO, revealing that he had sent out a company-wide email calling employees “dumb dolphins” and told a business partner, on the record in a deposition, that he would “staple him against a f*****g wall and burn him alive.”

Colorful stuff! was our takeaway back then and we stand by it.

Wildly incriminating statements aside, things were good for Better. Just a few weeks before the Forbes piece, the company had successfully raised a $200M round, valuing its business at $4B.

This week, things got even……… better for Better.

(I’ll show myself out)

On Tuesday, the SoftBank-backed company announced that it would go public via a SPAC merger with Aurora Acquisition Corp. Only six months after raising private funds at a $4B valuation, the SPAC deal now values Better at $7B. Not too shabby!

Last year, the mortgage company did $25B in loan volume, brought in $800M in revenue, and turned a profit. This year, through 2021Q1 alone, Better’s loan volume already exceeds $14B.

Elsewhere this week, Procore announced that it would price its upcoming IPO between $60-$65 per share, which would value the construction startup as high as $8.3B.

The proptech sector is hot.

An Offer You Can’t Refuse

This one’s for the movie buffs.

The Godfather is obviously the greatest movie of all-time and, among its many, many memorable scenes, Tom Hagen’s visit to film producer Jack Woltz’ house stands out as a personal favorite.

Well, movie aficionados can now own a piece of history: the Hearst Estate, which served as Woltz’ residence in the Brando-Pacino classic, is on the market.

Located in Beverly Hills, Jacqueline and John F. Kennedy’s honeymoon hideaway was first put up for sale in 2016 with a staggering $195M price tag. Since then, however, the owner has filed for Chapter 7 bankruptcy and the trustee recently cut down the price to a measly $89.75M!

Now THAT is an offer you can’t refuse. Seriously. Check out the property’s website.

(Severed horse head sold separately)

Obligatory Crypto Stuff

Last Saturday, Elon Musk made his much anticipated Saturday Night Live debut. In a sign of the times, this event was touted as the moment that would send Musk’s favorite meme coin, DOGE, to the proverbial moon.

As is often the case, Matt Levine best captured the Dogecoin zeitgeist:

Just imagine traveling 10 years back in time and trying to explain this to someone; just imagine what an idiot you’d feel like. “There’s going to be this online currency that people think is a form of digital gold, and then there’s going to be a different online currency that is a parody of the first one based on a meme about a talking Shiba Inu, and that one will have a market capitalization bigger than 80% of the companies in the S&P 500, and its value will fluctuate based on things like who is hosting ‘Saturday Night Live’ and whether people tweet a hashtag about it on the pot-joke holiday, and Bloomberg will write articles and banks will write research notes about those sorts of catalysts, and it will remain a perfectly ridiculous content-free parody even as people properly take it completely seriously because there are billions of dollars at stake.”

Sure enough, DOGE more than doubled in the week leading up to Musk’s appearance on SNL. Once the show aired, however, the price dropped 20% almost instantly.

Buy the rumor, sell the news. Speculating 101.

This didn’t stop Elon from continuing to pump his sh*tcoin on Twitter though. On Sunday, Musk announced that SpaceX would… well… here you go:

Then, in a wild reversal from a February announcement covered in these parts, Elon announced that Tesla would no longer accept Bitcoin as payment for its cars.

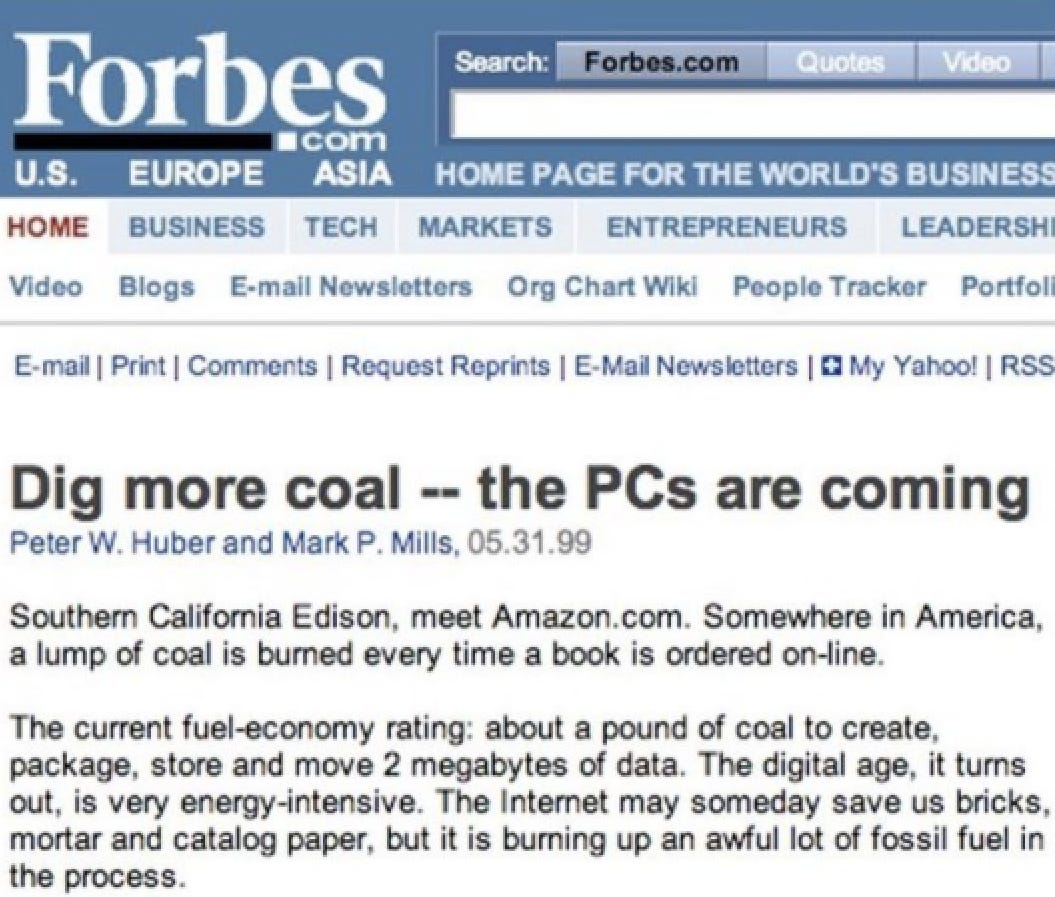

According to Musk, this decision was made in light of the environmental impact of Bitcoin mining; an energy intensive process that increases demand for coal. While that might be true, Elon also seized on the opportunity to announce plans to make DOGE more eco-friendly and hinted that Tesla may begin accepting it as a method of payment.

To our knowledge, no one knows how much DOGE Elon owns. If we had to guess?

Probably a lot.

Parting Thought

Though we admittedly question Elon Musk’s motives when it comes to DOGE, the “Bitcoin is bad for the environment” thesis is backed by some data and the ESG movement has been increasingly critical of the largest cryptocurrency.

It’s an interesting thesis; Bitcoin mining is absolutely an energy intensive process, but “Bitcoin consumes more energy than Argentina” is also an overly simplistic argument. Ultimately, where one lands on the subject probably depends on that person’s sensitivity to environmental concerns…

Anyways, the Instagram page @coingrams posted this screenshot yesterday and I thought it was interesting:

Just a bit of perspective going into boozy brunch o’clock.

Have a great weekend!