Hello all,

I figured some of you might be short on content with Matt Levine's paternity leave, so here are a few interesting articles I came across this week. I don't have 10% of Levine's talent and intelligence, so I will keep the commentary to a minimum.

Viable Defense

According to CNN, Theranos founder Elizabeth Holmes may seek a "mental disease" defense in her criminal fraud trial. According to the judge's order (attached), the examination will be recorded.

While Holmes is certainly innocent until proven guilty, defendants typically put their mental condition in question when the remainder of the evidence isn't favorable to them. The mental illness or defect could prevent defendants from having mens rea (lawyer-speak for a guilty mind or intent). If the allegations against her are true, a sociopathy defense might work.

Holmes has pleaded not guilty.

Putting the Customer First

After saving Brooks Brothers and Lucky Brand, Simon Property Group is now teaming up with Brookfield Property Partners to save another customer by buying JCPenney out of bankruptcy. It's the distressed buying the more distressed.

Right before COVID hit, Simon acquired Beverly Center-owner Taubman Centers for $3.6B.

SPAC to the Rescue

SoftBank's had their share of.... misses?...., but they might have a winner in OpenDoor. According to the infamous "people with knowledge of the matter," OpenDoor and Chamath Palihapitiya-backed Social Capital Hedosophia Holdings Corp. II are in talks to list the PropTech company at a $5B valuation. OpenDoor last raised in early 2019 at a $3.8B valuation. Chamath was an early executive at Facebook and is the founder of Social Capital.

Speaking of SoftBank

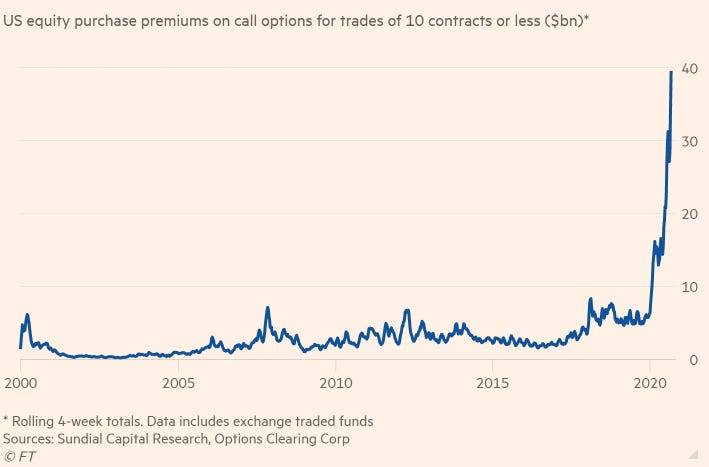

No one's ever accused Masayoshi Son of investing conservatively. Case in point, SoftBank reportedly bought $4B worth of options, representing a notional value of $30B, over the course of the summer.

Remember when SoftBank pumped up startup valuations? I present to you, premiums on call options:

Hot and Cold

On Tuesday, Nikola and Microsoft announced a strategic partnership, where GM would "provide Nikola with batteries, fuel cell systems and a factory." In return, GM would get an 11% stake in Nikola. Shares of Nikola jumped 41%.

On Thursday, Hindenburg Research published a scathing report on Nikola and disclosed a short position. The analysis is lengthy. TLDR: founder Trevor Milton is (allegedly) a chronic liar and Hindenburg likens Nikola to Theranos. Nikola fell 40%.

The Carlos Ghosn Affair

This Bloomberg article is two week old, but it's a fascinating read detailing the internal struggle at Nissan that resulted in Carlos Ghosn's arrest in Japan and escape to Lebanon, where he is now a fugitive.

The story contains all the hallmarks of a great corporate drama: a powerful CEO skimming off the top, insiders plotting to hack their company, footage of a government-sponsored raid on a whistleblower's home, etc.

This movie will be great.

That's It.

I may do this again next week too or I may never do it again. Time will tell.